10 Ways to Boost Security Beyond Cyber Security Awareness Month

As Cybersecurity Awareness Month concludes, financial advisors have an excellent opportunity to strengthen their digital security. Sensitive client information is increasingly at risk, having robust cybersecurity measures is essential to protect client trust, maintain compliance, and secure business success. Here are ten ways financial advisors can enhance their cybersecurity practices, supported by Digital Wealth Solutions’ features, ensuring safe client communications, secure document handling, and optimised advisory processes.

1. Implement Strong Cybersecurity Measures with Secure Cloud Solutions

Financial advisors need reliable, cloud-based platforms with strong encryption and data protection. Built on AWS, Digital Wealth Solutions ensures encrypted databases, file systems, and secure communications, allowing advisors to keep sensitive client information safe. A secure cloud platform is the foundation of strong cybersecurity for any wealth management or financial planning firm.

2. Offer Secure Client Portals for Financial Planning and Wealth Management

Providing clients with a secure client portal for financial planning goes beyond convenience—it’s essential. Digital Wealth Solutions’ client portal allows clients to securely access, review, and share financial advice documents, reducing the need for unsecure email communications and ensuring a streamlined experience for both advisors and clients.

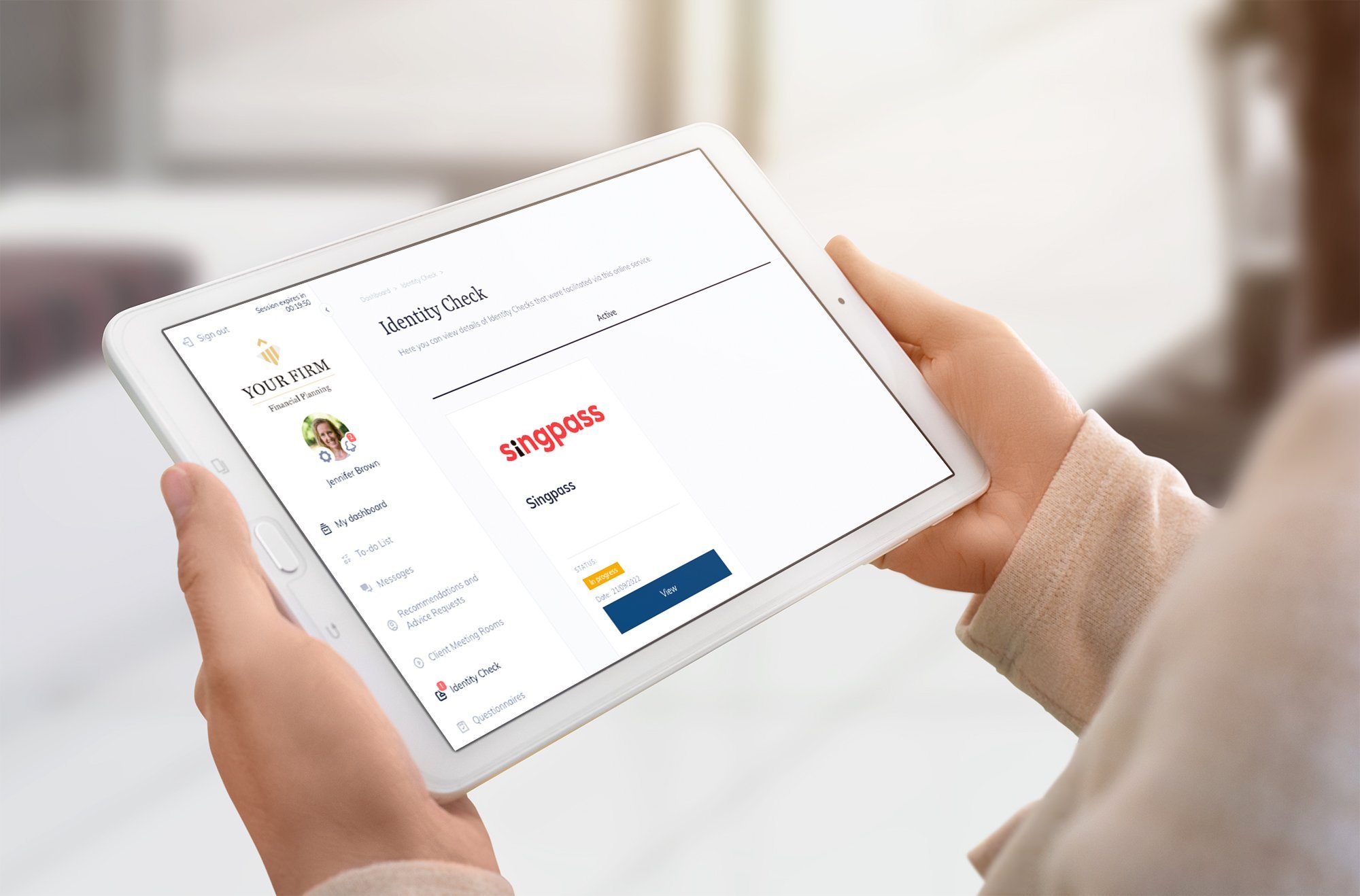

3. Use Enhanced Identity Verification Measures

Identity verification is crucial in safeguarding client data, especially in remote interactions. Digital Wealth Solutions integrates with advanced identity verification platforms like Singpass and iAM Smart and allows secure passport uploads, ensuring that your clients’ identities are verified quickly and securely within the platform.

4. Replace Traditional Emails with Secure, Encrypted Messaging

Email is one of the least secure forms of communication for financial advisors handling sensitive client information. Digital Wealth Solutions offers encrypted, built-in messaging, providing a secure and private channel for client-advisor communications and reducing the risks associated with unsecured email interactions.

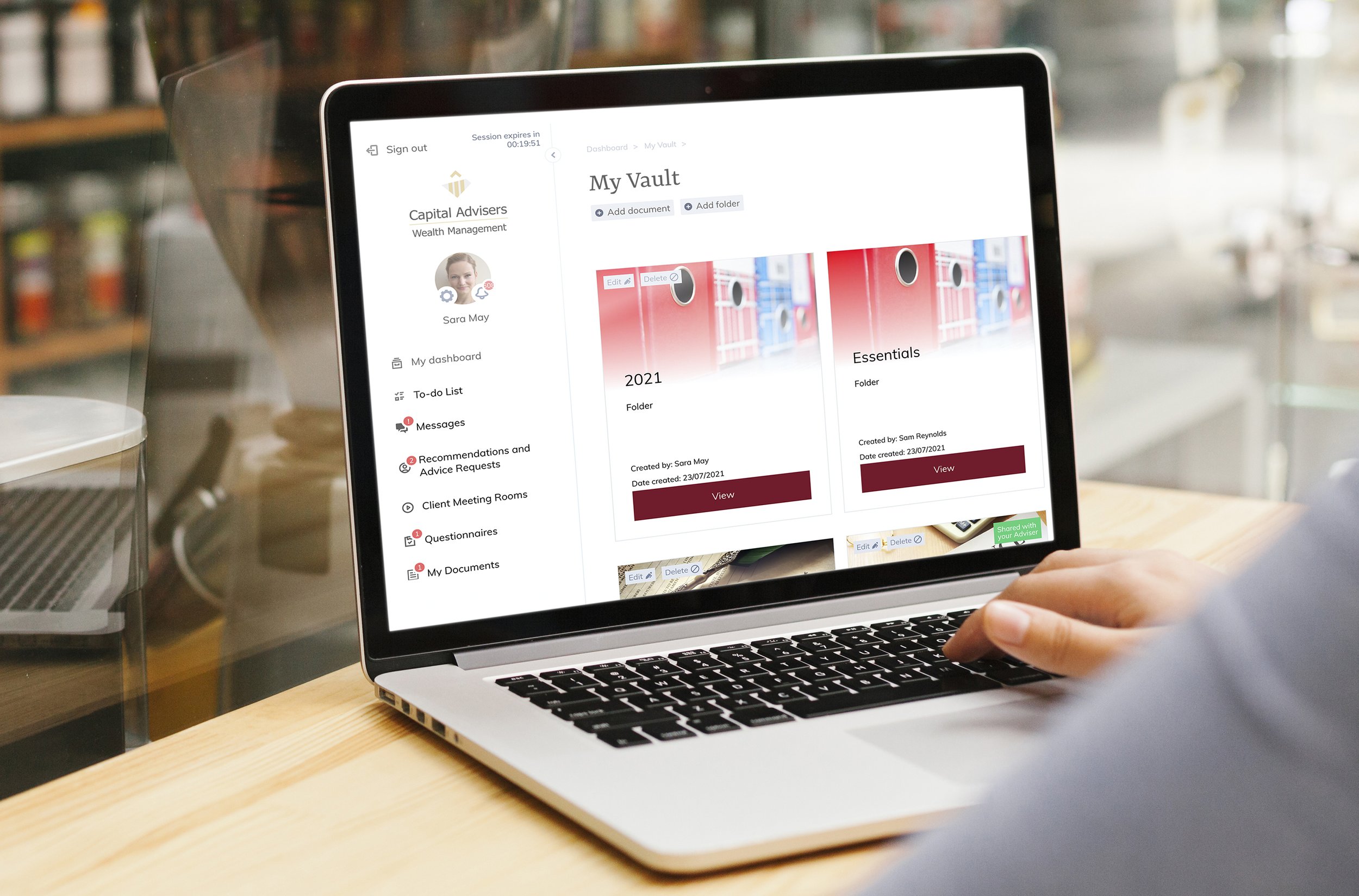

5. Streamline Document Handling with Digital Signatures and Secure Storage

Handling documents digitally requires secure storage and reliable signatures. Digital Wealth Solutions integrates with DocuSign and offers built-in e-signature options, ensuring documents are securely signed and stored in the client vault. This enhances security and maintains a compliant, well-documented audit trail for every interaction.

6. Establish Clear Cybersecurity Policies with 2FA Authentication

Cybersecurity policies are only as strong as their implementation. Digital Wealth Solutions enables two-factor authentication (2FA) for all user accounts, ensuring an added layer of security against unauthorised access. Combined with strong password policies, 2FA helps secure sensitive data within your client portal.

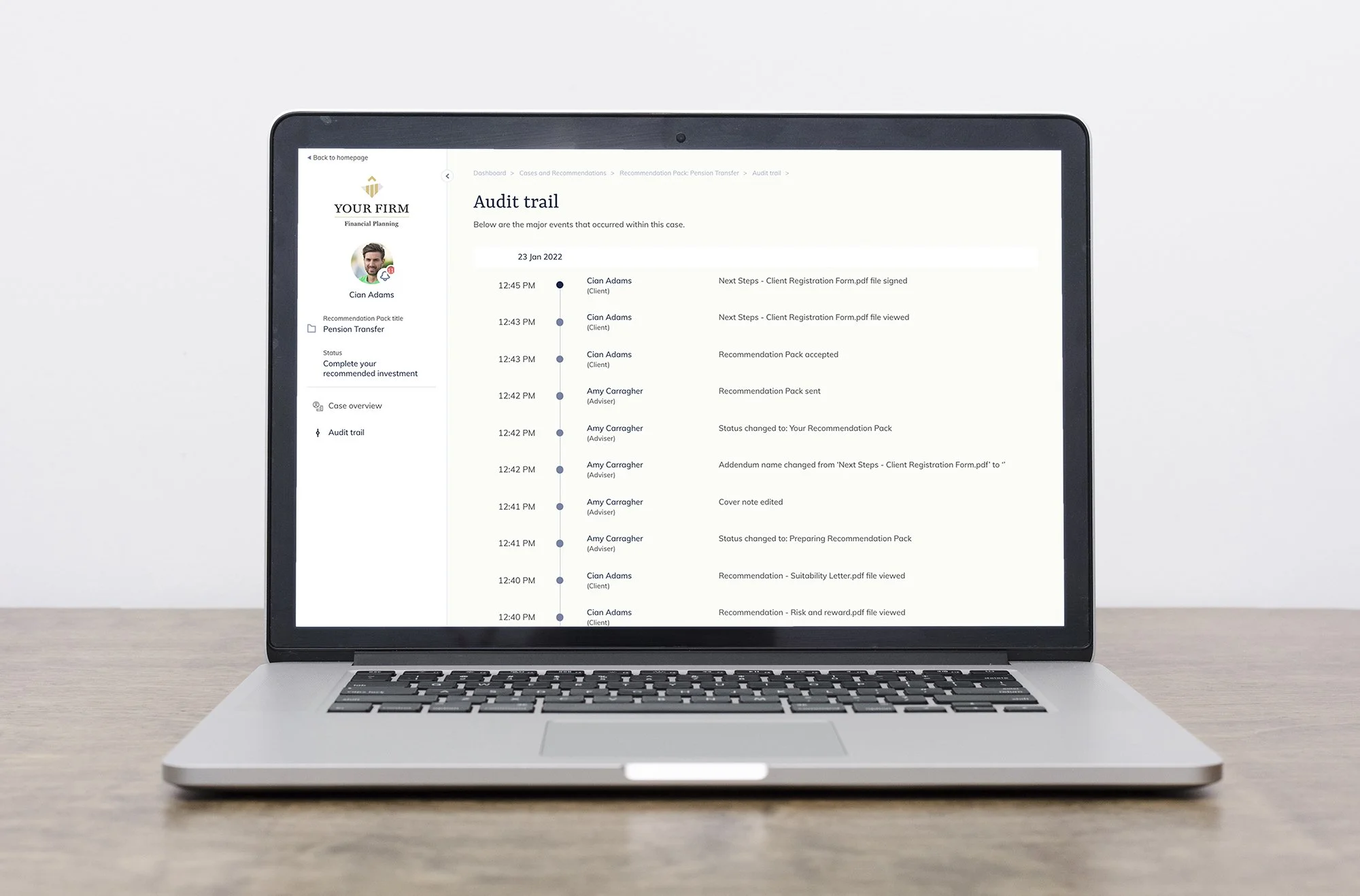

7. Keep Comprehensive Interaction Reports for Transparency and Compliance

Tracking client interactions is key for compliance in financial advisory services. With Digital Wealth Solutions, advisors can automatically generate detailed reports for all client communications, creating an audit trail that supports transparency and regulatory compliance, ensuring a well-documented history of interactions.

8. Prioritise Cybersecurity Training for All Staff

A secure advisory business goes beyond technology—staff awareness is also essential. Regular cybersecurity training sessions help keep everyone informed about best practices and new threats, creating a security-conscious culture within your financial advisory practice.

Rest assured with Digital Wealth Solutions’ Cyber Essentials+ certification, currently renewing for our third year.

9. Choose Tech Tools for Financial Advisors Focused on Security

Digital wealth management and advisor tech tools are essential for securely managing wealth and interacting with clients. Digital Wealth Solutions offers a suite of tech tools, including secure client portals, advanced client segmentation, and personalised financial planning, all built with security as a priority.

10. Regularly Update Security Measures and Keep Clients Informed

Financial advisors must stay ahead of cybersecurity threats by consistently assessing and updating security protocols. Digital Wealth Solutions offers continuous updates and built-in blogs to empower firms to educate and inform clients on best practices, helping you maintain secure and up-to-date systems.

Enhance Security with Digital Wealth Solutions

These ten cybersecurity tips help ensure financial advisors can protect client data, strengthen client relationships, and keep up with regulatory requirements. Digital Wealth Solutions provides advisors with essential tools for a secure, compliant, and efficient digital wealth management experience.

Ready to Enhance Your Cybersecurity? Book a demo today and discover how Digital Wealth Solutions’ secure client portal and advanced tech tools for financial advisors can elevate your security strategy.

Try our free 2-month trial and take a confident step into a more secure advisory future.